ETH Price Prediction: Analyzing Investment Potential Amid Technical Signals and Institutional Adoption

#ETH

- Technical Positioning: Current price near Bollinger Band support suggests potential rebound opportunity from oversold conditions

- Institutional Adoption: BlackRock's ETF filing and major transfers signal growing institutional confidence and capital inflow

- Network Development: Ethereum Foundation's interoperability initiatives address scalability concerns and enhance long-term value proposition

ETH Price Prediction

Technical Analysis: ETH Shows Potential Rebound Signals

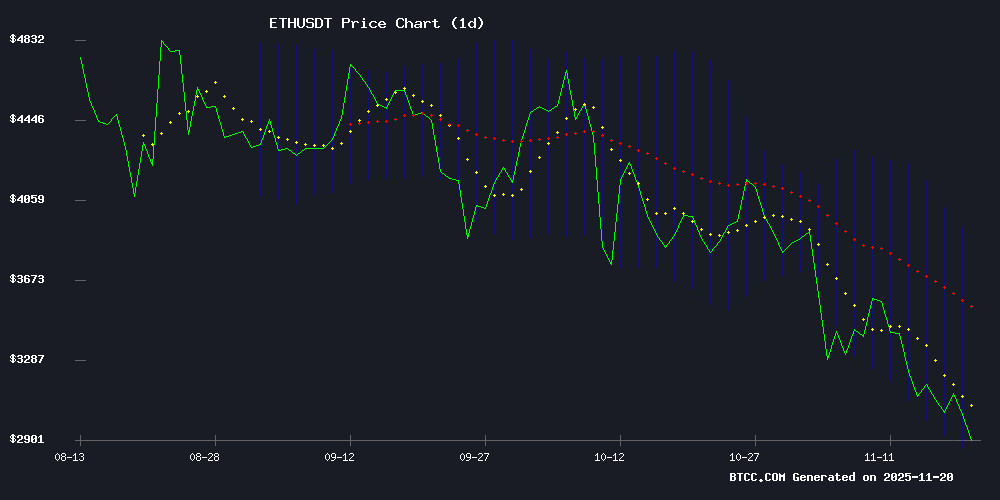

Ethereum is currently trading at $3,032.24, sitting below its 20-day moving average of $3,352.61, indicating short-term bearish pressure. However, BTCC financial analyst William notes that the current price position NEAR the lower Bollinger Band at $2,841.24 suggests potential oversold conditions. The MACD reading of -39.64 shows bearish momentum, but William believes the distance from the upper Bollinger Band at $3,863.97 leaves room for upward movement if buying pressure returns.

Institutional Adoption Fuels Ethereum Optimism

Recent developments signal growing institutional confidence in Ethereum. BlackRock's ethereum ETF filing with integrated staking represents a significant milestone for institutional adoption. BTCC financial analyst William emphasizes that the $17 million Ethereum transfer to Galaxy Digital during market weakness demonstrates sophisticated investor accumulation. The Ethereum Foundation's interoperability layer proposal addresses critical scaling concerns, potentially enhancing network efficiency and value proposition.

Factors Influencing ETH's Price

BlackRock Files for Ethereum ETF with Integrated Staking, Signaling Institutional Crypto Adoption

BlackRock has taken a decisive step toward launching an Ethereum ETF with staking capabilities, registering the 'iShares Staked Ethereum Trust' in Delaware. The move underscores the asset manager's strategy to blend traditional crypto exposure with yield generation—staking rewards currently average 3.95% annually.

The proposed ETF leverages the Securities Act of 1933, emphasizing regulatory compliance and transparency. Competitors like Grayscale have already secured approvals for similar products, but BlackRock's entry carries outsized weight given its $2 million ETH holdings and market influence.

This isn't exploratory—it's strategic. Nasdaq's July filing laid groundwork for the product, suggesting BlackRock intends to institutionalize staking as an ETF standard rather than follow existing trends.

Ethereum Price Prediction: ETH Price Eyes Bullish Breakout Above the Trendline as $3,000 Dip Sparks Strong Rebound Opportunity

Ethereum shows early signs of stabilization despite macro pressures, with market participation increasing around key support levels. A sustained move above trendline resistance could signal buyer control returning.

Spot Ethereum ETFs saw $74.2 million in net outflows yesterday, led by BlackRock's $165.1 million ETH sale. Yet the $2,950–$3,050 range is forming a potential base for recovery, with ETH currently trading near $3,020.

On-chain metrics indicate reduced speculative pressure, with funding rates and open interest easing after recent declines. The market now watches for confirmation of whether this consolidation precedes renewed upward momentum.

Ethereum Foundation Proposes Interop Layer to Streamline L2 Fragmentation

The Ethereum Foundation has unveiled plans for an Ethereum Interop Layer (EIL), targeting the growing fragmentation across Layer 2 networks. While rollups have successfully reduced fees and improved throughput, they've also introduced complexity—scattered liquidity, chain-specific wallets, and bridge dependencies now hinder cross-chain activity.

EIL's architecture allows rollups to maintain independence while enabling single-signature cross-L2 transactions through smart wallets. The proposal directly addresses community demands for reduced bridge reliance and lower transaction costs. Early reactions suggest this could marginalize third-party cross-chain services as wallet-native flows gain dominance.

This development marks Ethereum's latest attempt to reconcile scalability with unified user experience. By abstracting interoperability complexities into a shared layer, EIL may finally deliver the seamless multi-chain environment envisioned since Ethereum's early scaling roadmap.

SharpLink Transfers $17M in Ethereum to Galaxy Digital Amid Market Downturn

SharpLink, the first publicly listed company to adopt Ethereum as its primary reserve asset, moved 5,442 ETH ($17 million) to Galaxy Digital's OTC desk. The transfer coincides with a 20% decline in Ethereum's price, raising questions about the firm's strategy amid mounting unrealized losses.

The company holds 859,853 ETH ($2.6 billion) with estimated losses between $479-$500 million. Despite this, SharpLink reported a $104 million Q3 profit through Ethereum treasury management and staking rewards. Its stock has fallen 86% year-to-date.

Market observers are scrutinizing whether this OTC transfer signals a broader divestment strategy or tactical repositioning. Galaxy Digital's involvement suggests institutional-grade execution, potentially mitigating market impact.

Is ETH a good investment?

Based on current technical indicators and market developments, Ethereum presents a compelling investment case with both short-term trading opportunities and long-term growth potential. The current price of $3,032.24, while below the 20-day moving average, shows strong support near the $3,000 level with multiple rebound attempts.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $3,032.24 | Near Support |

| 20-day MA | $3,352.61 | Resistance Level |

| Bollinger Lower | $2,841.24 | Strong Support |

| MACD | -39.64 | Bearish Momentum |

BTCC financial analyst William suggests that the combination of technical oversold conditions and positive institutional developments creates a favorable risk-reward profile for investors with medium to long-term horizons.